Avoid violating Social Security requirements when working in the United States as an immigrant. Knowing how to acquire a Social Security number in the United States will help you legally attain gainful employment and begin building on your Social Security benefits.

immpreneur.com gathered the following essential information to answer some of the most important and more frequently asked questions about attaining Social Security numbers for US immigrants.

Does an Immigrant Automatically Get a Social Security Number?

No. Typically, only non-citizens authorized to work in the United States by the Department of Homeland Security (DHS) can attain an SSN. SSNs are used to report a person’s wages to the government and to determine an individual’s eligibility for Social Security benefits.

Prior to obtaining permanent residence status (green card), you must obtain an immigrant or nonimmigrant residence permit or be in the process before you can apply for an SSN.

How Do I Apply for an SSN?

You can apply for a Social Security Number and card in your home country (before coming to the United States) when filing an application for an immigrant visa with the US Department of State.

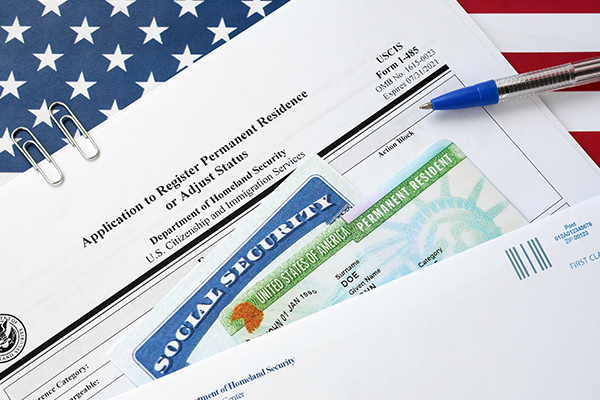

If you are applying for a new or replacement Social Security card using Form I-765 and/or Form I-485, we will issue your card within 7-10 business days after US Citizenship and Immigration Services approves your work authorization or Permanent Residence application.

You can find a downloadable I-765 Form – Application for Employment Authorization.

Important instructions for the I-485 – Application to Register Permanent Residence or Adjust Status.

Note: In most cases, if you apply for an SSN and card with your immigrant visa application, you will likely not need to visit a Social Security office upon arrival in the United States.

What Can Immigrants Get in Place of a Social Security Number?

An Individual Taxpayer Identification Number (ITIN) is a tax-processing number issued by the Internal Revenue Service (IRS) to ensure that people, including undocumented immigrants, pay taxes (even if they do not have or cannot attain a Social Security number) and regardless of their immigration status.

US residents, non-resident aliens, their dependents, or spouses can complete the required paperwork for an ITIN number online. Printed applications are also accepted by mail or in person at the IRS anytime throughout the year.

Download the W-7 form, then read about applying for an ITIN, and begin the application preparation at irs.gov/individuals/how-do-i-apply-for-an-itin

Can I Work Legally with an ITIN number?

No. Employers cannot accept an ITIN as a valid employee tax identification number for work eligibility.

The IRS will penalize companies and resident or non-resident aliens who use ITINs for US employment verification purposes. However, anyone assigned an ITIN who later becomes eligible to work in the US must then apply for a social security card.

How Much Does It Cost to Get an SSN or ITIN Number?

There is no cost to apply for an SSN or an ITIN number. However, Some private companies (not affiliated with Social Security or any other government agency) may charge you for their services in filling out application information or taking action on your behalf.

If you have already applied for an ITIN number and are trying to locate or request a copy of the number, you can call the IRS at 1-800-829-1040.

Likewise, for information about SSN numbers, you can call 1-800-772-1213.

Can I Work in the US Without a Social Security Number?

Yes and no. The Social Security Administration doesn’t require you to possess a Social Security number before you start work. However, the Internal Revenue Service requires employers to use your Social Security number to report your wages.

Tip: It is more prudent to wait until you are adequately documented before seeking or starting gainful employment. Otherwise, you will place yourself and your employer in jeopardy of costly fines, status revocation, or deportation.

US Immigration and Social Security

In this article, you discovered answers to frequently asked questions about the relationship between immigrant employment and Social Security numbers and how to properly apply for one.

When you apply for and receive a Social Security Number and card, you can legally start working in the US and accumulating credit toward your Social Security benefits.

Ignoring the need to attain a Social Security Number before getting a paying job will expose you to costly fines, potential immigrant status denial or revocation, and potential deportation proceedings.

Sources:

ssa.gov/ssnvisa/

itin-w7-application.com/faqs/can-apply-itin-online

irs.gov/individuals/how-do-i-apply-for-an-itin